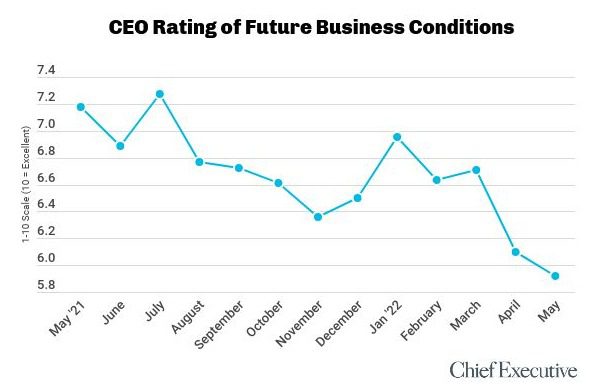

May Poll Finds CEO Optimism At Lowest Level In Almost 6 Years

Sector & Size View

Ratings for future business conditions varied widely by industry this month, with CEOs in financial services giving conditions the highest rating at a 6.3/10, up 4 percent since April.

“There was plenty of liquidity in 2020 & 2021, the US treasury and the administration printed $6 trillion. High equity reserves, corporate and individual savings. The wealth transfer for the next 10 to 15 years will be in trillions. There will be a return to reasonable IRR/yields to investment,” says George Gelis, President at Surge Financial Group, Inc. He rates future business conditions as a 9/10.

CEOs in real estate who rate future conditions as the lowest of the bunch, giving them a 4/10, are worried about inflation and supply chain issues, as well as a lack of available talent.

One CEO in real estate says, “There is poor productivity due to remote work and hybrid work. All companies have had to expand hiring needs with limited real revenue growth and inefficiencies,” to explain why he rates future conditions as a 3/10.

The rating of CEOs in professional services dropped by 14 percent month over month, due to continued inflation and dampening demand because of higher prices. CEOs in industrial manufacturing also suffered a blow to their optimism, with their rating falling by 7.5 percent since April. They have been navigating rising energy prices, the race for talent and global supply chain disruptions.

Read the original article from ChiefExecutive.net

Being an expert navigator is the key to innovation success

Whenever Swiss explorer Sarah Marquis tells people about her newest expedition, she gets the same reaction: “You’re crazy!” If she listened to these people, she’d cease to explore at all.

Marquis is an adventurer who’s spent much of her adult life trekking solo through some of the world’s most forbidding regions, from deserts to jungles to mountain ranges, living off the land and blazing her own trails. In 2014, she was named Adventurer of the Year by the National Geographic Society. Her experiences underline the importance of navigation when venturing into the unknown.

She emphasizes that successful navigation starts with preparation. For a three-month expedition, Marquis typically spends two years learning about the area and planning the route and logistics, adding intense workouts during the second year. She also has to reach out to potential sponsors and supporters. And that means crafting an engaging story about the forthcoming journey.

Much of what Marquis needs to do to prepare is analogous to what innovators should do when trying to bring their ideas to life or challenge the status quo. For their ideas to survive, they also must anticipate the likely threats, asking themselves: What “language” do people speak in this organization or sector, and do I understand them? What historical tensions may I encounter? What gear will I need to take? Where will I find additional resources along the way? What dangers should I take into account?

Read the original article here

M&A success depends on 'Announcement Day' credibility

Dive Brief:

- Investors negatively reacted to six out of 10 mergers and acquisitions from 1995 until 2018, and less than half of the transactions yielded the promised value, according to an M&A study that the researchers say underscores the importance of presenting a convincing argument for a deal on Day 1.

- Businesses tend to focus on getting the deal approved rather than on providing investors during announcement day with a detailed roadmap for ensuring that the deal works, according to Mark Sirower, co-author of the recently published “The Synergy Solution” that focuses on 1,267 deals during three merger waves.

- “You’re trying to solve a classic asymmetric information problem, which is that management presumably knows more about the numbers than investors,” according to Sirower, a leader in M&A and restructuring at Deloitte. “Investors want to know that you have a plan, so if you signal that you don’t have a plan and you’re going to pay a 20%, 30% or 40% premium [for the acquired company], then you’re going to lose that value” in share price over time.

Dive Insight:

Early this year CFOs planning to push forward with M&A found inspiration from 2021, when deal-making by many measures hit record levels fueled by ample available capital, record-low borrowing costs and a robust stock market.

The deals market slumped during the first quarter. Faster inflation, slower growth, rising interest rates, stock market volatility and geopolitical instability stemming from Russia’s invasion of Ukraine prompted CFOs and other deal-makers to pause in deal-making.

Read the original article from CFO DIve

The surprising link between creativity and risk

Some of the links between creativity and risk are pretty self-evident. Creativity is all about trying something new, exploring the unknown, and accepting uncertainty and the possibility of failure. In the corporate setting, we understand intuitively that creativity fuels strategy, innovation, and growth. In a world where machines are taking over predictable, tedious tasks, it’s no surprise that there’s a mounting premium on the kinds of skills, such as creativity, that machines cannot (yet) replicate.

But there’s a less appreciated benefit of creativity that is just as powerful. Creative employees are more likely to take the kind of “good” risks that lead to innovation. They’re also willing to take the social risk of speaking up to help to steer the team out of harm’s way. That’s why the squeaky wheel—the whistleblower, the skeptic, the constant questioner—may also be a reservoir of creativity.

To understand how these qualities are related, it helps to broaden how you think of creativity.

Risk, creativity, and vision

Many people associate art with creativity and innovation. But most of us only think of half of the picture when it comes to artistic creativity. Drawing is a highly transferable skill that, beyond its purely aesthetic applications, has been used in every great idea and invention throughout history, says the artist Drue Kataoka, who works at the intersection of art and technology.

Read the original article here

Is vertical integration making a comeback?

In the headlines crawling across the screen, you can glimpse vertical integration’s revival, as companies reveal plans to control and own aspects of their business that they were until recently content to let suppliers handle. In November, Ford announced that it would partner with GlobalFoundries to develop and produce computer chips. Last summer, Home Depot chartered its own container ship. Ikea, not to be outdone, is purchasing its own shipping containers.

Related stories

Vertical integration is one of those concepts taught about in business school, an essential step in the development of industrial capitalism, along with the assembly line and interlocking parts. Its mere mention evokes sepia-toned memories of the great industrialists of a century ago who harnessed steam, steel, and electricity to create truly massive enterprises.

The thinking behind vertical integration was that it made sense for a company to control as many links in the value chain as possible. Each time something moved through a step of production—from commodity source to processor, from part-maker to assembler, from finished good to distribution, from distribution to retail—somebody would shave off some profits. If you were a hypercompetitive, efficiency-seeking machine, vertical integration offered a twofer: you could iron out costs, thus making your product more affordable for more consumers, while hoovering up those profits for yourself.

Read the original article here

IaaS vs SaaS: What Is The Difference?

Infrastructure-as-a-Service (IaaS) and Software-as-a-Service (SaaS) are two of three cloud computing models in addition to Platform-as-a-Service (PaaS). In fact, SaaS can be integrated into an IaaS, so you don’t have to choose between the two.

It’s important to know their differences because each one delivers service at a different layer of the cloud tech stack. Knowing your company’s particular needs is the first essential step in determining whether to adopt IaaS, SaaS, or both.

Read more at TechRepublic about how IaaS, PaaS, and SaaS fit together: SaaS, PaaS, IaaS: The differences between each and how to pick the right one

What is IaaS?

Infrastructure-as-a-Service (IaaS) entails an array of services that a vendor provides clients, namely on-demand, pay-as-you-go access to storage, networking, servers and other computing resources in the cloud. IaaS replaces a company’s traditional data center, so it’s essentially an outsourced cloud infrastructure made up of virtualized servers, routers, and other components of a data center.

IaaS use varies by company size and type, but an IaaS is typically used for the following functionalities:

- Software development

- Website hosting

- Web applications management and support

- Server resource

- Content delivery

- High-performance computing

- Data warehousing and analytics

- Data storage, backup, and recovery

According to a Gartner report, the IaaS market in the US is projected to reach $126 billion by the end of 2022. Though still not as large as the SaaS market, IaaS market growth is outpacing that of SaaS. While SaaS has grown 42 percent between 2020 and 2022, the IaaS market has grown at more than twice that rate at 89 percent. Major IaaS providers are AWS, Azure, Google Cloud, and Oracle Cloud.

Read the original article from CIO Insight

Leadership Skills for Product Owners

Why Leadership Matters

An entrepreneur comes up with an idea, and tries to get funding for it. They prepare the best “deck” or “stack” of slides, and armed with business knowledge, data, sales skills, storytelling and more, they try to convince venture capitalists that their ideas are worth the investors’ money. If they succeed, they may just create something of value to the world and to their nascent company. If they fail, they don’t.

When they get funding, they’ll build, measure and learn, and decide whether to persevere or to pivot. Their leadership will be responsible for the success, or failure, of the company, perhaps with partners, but that’s a very small group of people, who are already onboard. We’ve all heard of these pivotal founders and the organization structures they create, to shape companies in their image, e.g. Steve Jobs. This funny illustration below shows just how much the leadership, and the character of the leader/s of a company, affects its structure (notice Apple under the late Steve Jobs, for example).

Read the original article from Management 3.0

Five Ways Hackers Target The Personal Lives Of CEOs

At a time when many CEOs are reevaluating their companies’ risk of cyber-attacks due to the growing tensions with Russia, it is also important that CEOs take additional measures to protect themselves from direct personal attacks – as hackers are increasingly targeting executives in their private lives in order to pull off large corporate breaches.

C-suite executives are the ideal target for any hacker, since these individuals have the greatest level of access within the company, they often have sensitive data stored on their devices, they can access the company’s financial accounts, and their email account (or other communication channels) can be used to instruct other employees to perform sensitive tasks like wire transfers.

Executives are usually well-protected when inside the corporate network, but in many cases that security vanishes as soon as they step outside. Their home networks, personal devices and personal accounts often have little to no meaningful protection.

This makes them an easy target for hackers, and we are seeing a significant increase in both criminal and nation-state operations that are zeroing in on executives as the initial point of attack.

Read the original article from ChiefExecutive.net

How subsidiaries can emerge as "centers of excellence"

Over the past several years, corporate subsidiaries have gone from performing necessary but relatively low-value functions for multinational firms to serving as proving grounds for vital drivers of knowledge, innovation, and value creation. Some subsidiaries are now dubbed centers of excellence (CoEs) by their parent company, meaning they cultivate specific skills and knowledge that can be conveyed to and leveraged along a multinational’s network.

How does this evolution take place? The authors of a new study looked into an IKEA supplier, which operates three factories in Poland, to learn more.

IKEA — known for its global reach and stylish yet affordable furnishings — was an ideal subject for the study, because few multinational firms play so vital a role for their subsidiaries. The authors held nearly 50 interviews with managers at both IKEA and the subsidiary in 2001–03, 2007, and 2014, as well as looking back at the relationship since the mid-1980s. Participants were asked about the subsidiary’s activities, resources, and competencies, as well as how its relationships with headquarters, other IKEA subsidiaries, and external suppliers had evolved. The authors also visited the subsidiary several times and observed production and organizational processes.

Over the period of study (1986 through 2014), the business unit evolved from a supplier to an important production hub. IKEA approached the business to be a supplier in the 1980s, intrigued by a technology the factory used to produce cabinets.

Read the original article here

Appointment of women to Fortune 500 boards hits record high

Dive Brief:

- Fortune 500 boards appointed a record share of women in 2021 while also seeking out experts to help manage the risks and emerging regulation regarding cyberattacks and business sustainability, according to Heidrick & Struggles.

- The boards last year filled 45% of 449 openings with women directors compared with 41% in 2020, while appointing 41% of directorships with ethnically or racially diverse candidates, Heidrick & Struggles said. Meanwhile, the proportion of current or former CFOs tapped to boards fell to 14% from 21% in 2020.

- “Boards continue to seek fresh thinking as evidenced by the appointment of directors with more diverse backgrounds,” Heidrick & Struggles Vice Chair Bonnie Gwin said.

Dive Insight:

Companies face rising pressure from industry associations, federal regulators, lawmakers and both institutional and retail investors to make diversity of their boards, C-suites and workforce one of their top priorities.

The Business Roundtable, made up of large U.S. companies with 20 million employees and more than $9 trillion in total annual revenue, has committed to increasing diversity and providing metrics on the demographics of corporate boards, senior executives, workforces and suppliers.

Securities and Exchange Commission (SEC) Chair Gary Gensler has called workforce a critical asset of growing interest to investors and has asked agency staff to recommend disclosure mandates on specifics such as employee diversity, compensation and turnover.

Read the original article from CFO DIve