4 reasons CFOs should lead the charge on the great resignation

We’re well into 2022, and it doesn’t look like the Great Resignation is tapering off. After 48 million people left their jobs in 2021, the pace of quits has only increased, to 13.2 million in Q1 of 2022 and an all-time high of 4.5 million in March. Clearly employees are still unsatisfied. And a recent Willis Towers Watson survey of nearly 10,000 US employees in large and midsize private employers showed 44% of employees are “job seekers” and 56% cite pay as a top reason they’d look.

CFOs have taken notice. A recent Deloitte survey of CFOs recently reported that retention is the number one concern of CFOs right now.

The good news: they’re in a great spot to do something about it. Here are four key reasons why.

1. Hiring budget: plan versus reality

Great CFOs are strategic operational leaders. As a result, in many companies they pull double duty as COOs and run HR and recruiting teams. Candidate experience matters, especially at the negotiation phase.

As the war for talent continues, the hiring budget you may have laid out for a particular role or department may not be realistic. Make sure your budget reflects market reality, and your hiring managers know the negotiation boundaries they need to stick to. Don’t let confusion slow negotiations and lead strong candidates to slip through your fingers.

Read the original article from CFO DIve

More U.S. Factories Won’t Fix Your Supply Chain Mess

“Let’s bring manufacturing home!”

This sounds like a straightforward solution to the disruptions currently plaguing the supply chain—which have only been amplified by the Ukraine-Russia conflict.

Unfortunately, the answer isn’t so simple.

Supply chains are big, complex systems. We can shift certain pieces left or right, but that doesn’t mean we’ll see immediate relief. Take oil, where conventional wisdom might suggest an increase in domestic drilling. Yet ConocoPhillips CEO Ryan Lance feels otherwise, stating it would take at least another year before increased drilling would bring more oil to the U.S. market.

To actually dig out of the supply chain rut, leaders need solutions that help in both the short and long term.

Nearshoring, not reshoring

If we just open up a bunch of factories in the U.S., we’ll own the supply chain from end to end. Right?

Not so fast. The truth is that much of what we consume still comes from the earth in its raw form, and there are limits to where we can get those materials.

Read the original article from ChiefExecutive.net

Reframing The Conversations At Work

The crucible of the pandemic may be contributing to burnout and the ongoing Great Resignation affecting employees and managers alike. But for Lia Garvin, a team operations manager at Google with prior stints at Microsoft and Apple, the current pressures don’t alarm her. Instead, she sees it as an ideal moment to reframe the conversation at work.

Garvin, an executive coach whose observations of thorny business problems helped spark the idea behind her new book, Unstuck: Reframe Your Thinking to Free Yourself From the Patterns and People that Hold You Back, suggests combating burnout among workers and employers by creating an experimental mindset that invites feedback. She encourages managers to recast how they ask questions to help their employees find solutions for themselves.

Garvin spoke with sister site, StrategicCHRO360.com, about getting inspired, developing teams that can effectively bridge hybrid and remote distance, and fostering a culture where employees feel supported even after making mistakes.

We are at this tricky time when it comes to recruiting and retaining talent. There’s a lot of talk about burnout. What are some of the best strategies you’ve found for finding and keeping top people motivated?

It’s interesting the interplay between motivation and burnout.

Read the original article from ChiefExecutive.net

Companies need to align efforts at disclosure, cybersecurity: SEC attorney

Dive Brief:

- Companies facing sharper regulatory scrutiny of their cyber weaknesses need to coordinate employees devoted to cybersecurity with those responsible for disclosing cyberattacks, according to Brent Wilner, a Securities and Exchange Commission (SEC) senior counsel.

- “What you have here is sort of this disconnect between the real cybersecurity experts — the people who can, you know, the CISOs that understand the nature of the incident, the nature of the breach, the nature of the information that’s been exposed — and the people who are making the disclosure,” according to Wilner, senior advisor to the SEC’s Crypto Assets and Cyber Unit.

- “Public companies need to be mindful of how they can bridge that gap,” Wilner said Thursday at Securities Enforcement Forum West. “This is really critical.”

Dive Insight:

The SEC under Chair Gary Gensler has bolstered investor protections against losses in crypto markets and mismanagement of cyber risks.

The SEC in March proposed tougher, more detailed rules for cybersecurity disclosure, including deeper company reports on cyberattacks and regular filings on cyber risk management, governance and strategy. Companies would need to report breaches within four days.

“Consistent, comparable and decision-useful” disclosure standards “would strengthen investors’ ability to evaluate public companies’ cybersecurity practices and incident reporting,” Gensler said before the commission approved the proposal in a 3-1 vote.

Gensler this month announced plans to expand the SEC’s Cyber Unit to 50 enforcers from 30, adding investigative staff attorneys, trial counsels and fraud analysts and renaming it as the Crypto Assets and Cyber Unit.

Read the original article from CFO DIve

Pop-up ports are here to stay, but the long-term solution is data

We hear daily about supply chain disruptions. Once again, the Port of Shanghai is shut down for Covid creating shipping disruption that looks more like an offshore blockade of the China coastline and will take months to unravel. This comes on top of the Ukraine war disruption and fundamental restructuring of supply chains to support new business models including the direct-to-customer movement.

Although the recent disruptions highlight the fragility of global supply chains, the disruption is fundamentally driven by higher volumes transported by larger ships using paper-driven workflow that has been years in the making.

One of the bottlenecks frequently highlighted is the congestion at America’s ports. While none of America’s ports are in the top 10 busiest globally, America’s aging infrastructure is especially apparent at U.S. coastal ports and waterways where steady growth in shipping and ever larger container ships have placed significant stress on the ability of our ports to handle the loads. This is causing significant backups that result in major global supply chain disruption as ships anchor offshore and containers sit in yards awaiting transport to final destinations. It’s a never-ending battle that goes well beyond the Covid issues that are frequently blamed.

To alleviate port congestion, the busiest ports are finding creative ways to stage containers closer to the customer by creating pop-up ports that make use of unused rail yards and other underutilized real estate close to main transportation arteries.

Read the original article from SCMR

Twitter execs depart, hiring freeze begins

Following the announcement, Agrawal held a company-wide town hall meeting, saying there were no plans for layoffs “at this time.” It’s been six years since Twitter made significant cuts to its staff, eliminating 350 positions primarily in the sales and marketing departments, according to CNN.

Some Twitter employees, like Edward Perez, a director of product management, have aired their concerns on the social media platform.

I can’t speak for all @Twitter employees; I can only speak for myself: It's a time of genuine discomfort & uncertainty.

Most of us believe deeply that Twitter is much more than a tech platform; we have a deep responsibility to society. I hope our new owner gets that. https://t.co/DY1nBEG4Dt

— Edward Perez (@eddie1perez) April 25, 2022

Others have taken to Blind, an anonymous professional social network with more than five million users. Professionals predominantly in the technology and finance industries turn to the free app to seek career advice and workplace insights, such as compensation figures, company culture, interview advice and sometimes even gut checks for their personal lives.

“Pretty stressed tbh. I feel like going from public -> private is opposite of what you want from a comp perspective. If comp is negatively affected, then we’ll lose a lot of great talent and any incentive for working at Twitter will be gone. "

Read the original article here

How Cookie Loss Is Affecting Enterprise Marketing Strategies

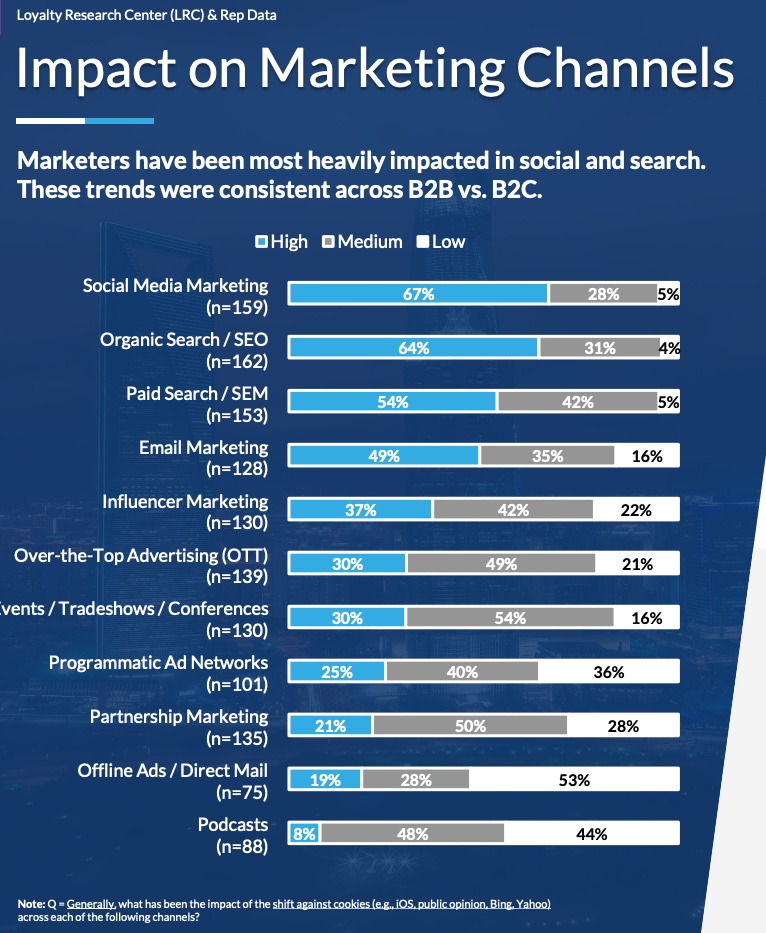

Marketers at big firms say the shift towards privacy and the depreciation of online cookies has had the greatest impact on their social media marketing and search marketing—and has also led them to invest more in those channels, according to recent research from Loyalty Research and Rep Data.

The report was based on data from a survey of 175 marketing leaders at Fortune 500 companies.

Most respondents say the move away from cookies and other identifiers by companies such as Apple has had a high impact on their social media marketing (67% say it has had a high impact), organic search strategies (64%), and paid search marketing (54%).

As a result of the loss of cookies, most enterprise marketers expect to invest more budget over the next two years in social media marketing (83% expect to invest more), paid search (82%), and organic search (73%).

Read the original article from Marketing Prof

DiversityInc 2022 Top 50 Event: The Link Between DEI and Financial Performance

More and more investors are holding companies accountable for reporting on and disclosing the diversity of people on their board, which could incentivize companies to do more in terms of their DEI efforts.

During a Fireside Chat with DiversityInc CEO Carolynn L. Johnson titled “The Link Between DEI and Financial Performance,” Jose Minaya, CEO of financial planning company Nuveen, said the SEC’s approval of the Nasdaq’s request to require board diversity disclosures for companies listed on its stock exchange will fuel transparency and accountability when it comes to practicing and reporting on DEI.

Minaya said some thought what Nasdaq did was bold, which he said is “interesting it’s even considered bold.” It simply requires companies to hold themselves accountable and be transparent, which in turn could possibly lead to companies better diversifying the people on their board.

What does transparency mean in terms of workforce analytics, Carolynn asked. What is Nuveen looking for in transparent reporting from the companies it works with?

Read the original article here

Are You Tracking the Customer Service Metrics That Really Count?

The biggest customer service problem for many managers is that they focus almost exclusively on day-to-day tactical customer service issues and fail to develop the latent, strategic customer service opportunities that would lock in and grow their most important customers. Here’s a typical situation.

Several years ago, we facilitated a workshop on customer service for executives. About 30 top managers gathered for a full-day session. We shared our latest research findings and invited leaders from Ritz Carlton Hotels, Disney, and a few other customer service leaders to share their insights. At the end of the day, we led a session in which the participants discussed their thoughts and experiences in turbocharging customer service.

We started the session by asking, “What is customer service?” This straightforward question drew a variety of more-or-less expected responses: line fill, case fill, answering the phone in 30 seconds, no telephone tag, fast order cycles, etc. The thread that linked these responses was that they were all tactical operating measures.

More importantly, they were all internal metrics. This is a common problem. For example, what good are high fill rates if the customer has too much of the wrong inventory? Or if the customer is ordering twice as often as is economical? Or if their phone call about a disruptive service problem that shouldn’t have arisen in the first place was answered quickly?

Read the original article here

How to Build Strong Business Relationships — Remotely

Although many managers have adapted to virtual meetings to replace face-to-face ones as a result of the Covid-19 pandemic, developing new business relationships online presents a particular set of challenges. Because successful relationships are built on trust, it’s critical to make an effort to work around virtual interactions’ shortcomings.

As described in our book, Searching for Trust in the Global Economy, just prior to the pandemic, we interviewed 82 managers from four regions of the world about how they decide to trust new business partners. Their answers varied by region and culture. For example, we found that managers in both Latin America and the Middle East/South Asia wanted to spend time getting to know potential new business partners in person in order to establish trust. In Latin America, managers were using that time to assess potential business partners’ shared values, whereas in the Middle East/South Asia, managers were focused on assessing respect for different values.

Then in November and December 2020, we re-interviewed 21 of those managers and asked them how the pandemic was affecting their ability to develop new business relationships. We found that their cultural differences were still active. For example, trust did not change during the pandemic. It was still low in Latin America and the Middle East/South Asia relative to East Asia and the West.

Read the original article here